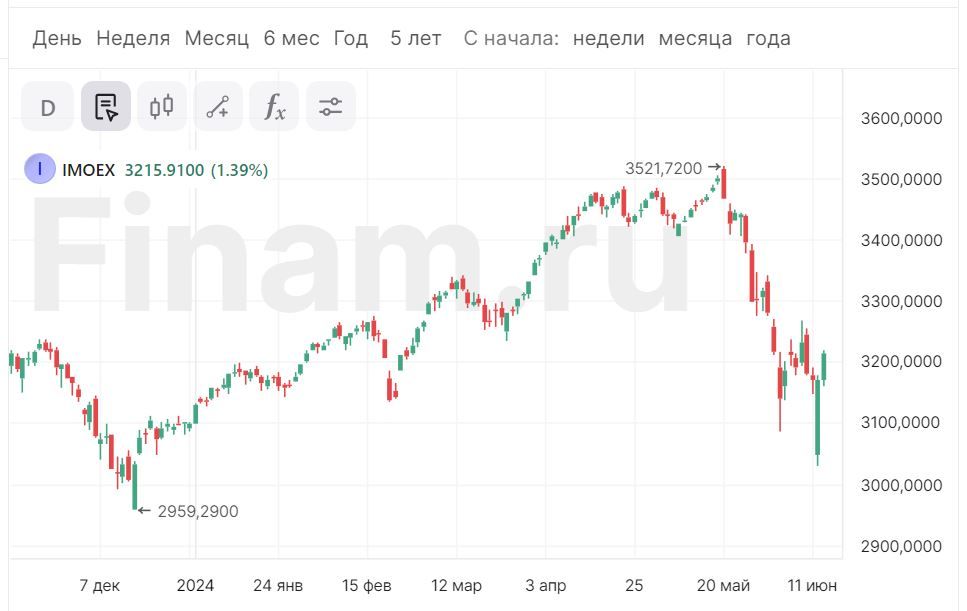

The past week was shortened but challenging and nerve-wracking for investors. Over the four trading days, the Russian market almost completely lost the previous gains. On Monday, the Moscow Exchange index dipped below 3200 points as market participants assessed the impact of the Central Bank of Russia’s rate decision. On Thursday, following the weekend, the market fell on news of new sanctions, pushing the indices to their lows since December 15. However, today positive dynamics were observed on the trading platforms, with no traces of the previous negativity.

Gradually, investors are getting used to the new rules, realizing that yesterday’s reaction was overly emotional. Stock indicators managed to recover from Thursday’s slump today. At the close of trading, the Moscow Exchange index rose by 1.4% to 3215.91 points, while the RTS index climbed by 0.42% to 1137.45 points.

“The US sanctions imposed on more than 200 Russian and Chinese companies should not cause significant harm to many companies on the list. Investors understand this, and the market is regaining its positions,” says Nikita Stepanov, an analyst at Finam.

Aside from the reduced concern over the recent sanctions, statements made by the President of Russia at the Ministry of Foreign Affairs have also influenced the market. Conditions for a peaceful resolution of the conflict with Ukraine were outlined, including the lifting of Western sanctions on Russia and the withdrawal of Ukrainian troops from new Russian territories. The Economist published an article speculating that negotiations between the parties could begin closer to the end of 2024.

Closing the currency exchange market forced investors to get used to the new way of trading, but did not cause a significant change in the ruble exchange rate. On Thursday, the currency market transitioned to an OTC segment for trading the dollar and euro. However, major and mid-sized banks did not note an increase in client demand for currency. The only significant change at the moment is the yuan becoming the primary indicator in Russia’s foreign exchange market.

“The new package of sanctions will increase pressure on imports in Russia, leading to an expansion of export currency revenue surplus, as well as further increasing the use of the ruble in foreign trade operations. According to the latest data from the Central Bank, April saw a historical peak in the use of the ruble in import settlements (41%),” commented PSB analysts.

Support from the tax period, with peak payments on June 28, will begin to be provided to the ruble next week. Exporters will convert foreign currency revenue into rubles in preparation for these payments.

Meanwhile, the official exchange rate of the Central Bank shows a substantial weakening of the ruble against the dollar. Dmitry Babin, an expert on the stock market at BCS World of Investments, believes that pressure on the Russian currency may gradually intensify due to a significant drop in oil prices that began in mid-April. The commodity factor, with a lag of 2-3 months, affects the volume of currency inflow into the country from exports.

The Russian debt market is attempting to recover. After three sessions of decline, the RGBI government bond index was able to rise by 0.14% to 107.69 points today.

As of June 14, the official exchange rate of the dollar at the Central Bank was 89.066 rubles per dollar, while the euro was at 95.151. The yuan exchange rate on the exchange today dropped by 0.58% to 12.15 rubles. The nearest futures contract on the dollar exchange rate (Si) fell by 0.05% to 89.12 rubles per dollar.

The leaders in growth on the Russian stock market were Aeroflot’s shares (+5.6%). Natalia Milchakova, a lead analyst at Freedom Finance Global, attributes the strength of the airline carrier’s shares to the beginning of the vacation season. Operational reporting for January-May 2024 also supported the shares.

Despite being included in the sanctions list, Novatek’s shares (+2.4%) closed in the green. The growth in LNG exports in January-May by 3.8% supported them.

After being hit by sanctions, Moscow Exchange shares (-3.7%) predictably were at the bottom. Pressure was also exerted by the approaching date for shareholders to register for dividends.

The announcement by Moscow Exchange of the start of trading on Monday, June 17, for PJSC MD Medical Group (Mother and Child), which has completed redomiciliation, became interesting. The move will allow the company to return to paying dividends, which will be a long-term driver for share growth. “However, it’s worth noting the potential hanging of shares, which will likely restrict their growth in the early days of trading, as was the case with TCS Holding and VK,” noted Nikita Stepanov.

Oil prices provided support for the bullish sentiment in the market. At present, Brent crude oil futures are up by 0.9% to $82.89 per barrel, while Light crude oil has strengthened by 0.7% to $78.7 per barrel. Given high consumer activity and increased demand from the transportation sector, further growth to $85 per barrel and beyond can be expected.

The Moscow Exchange index has shown significant growth for the second consecutive day. Analysts agree that the next increase will continue, and the ruble index may consolidate in the range of 3150-3240 points.