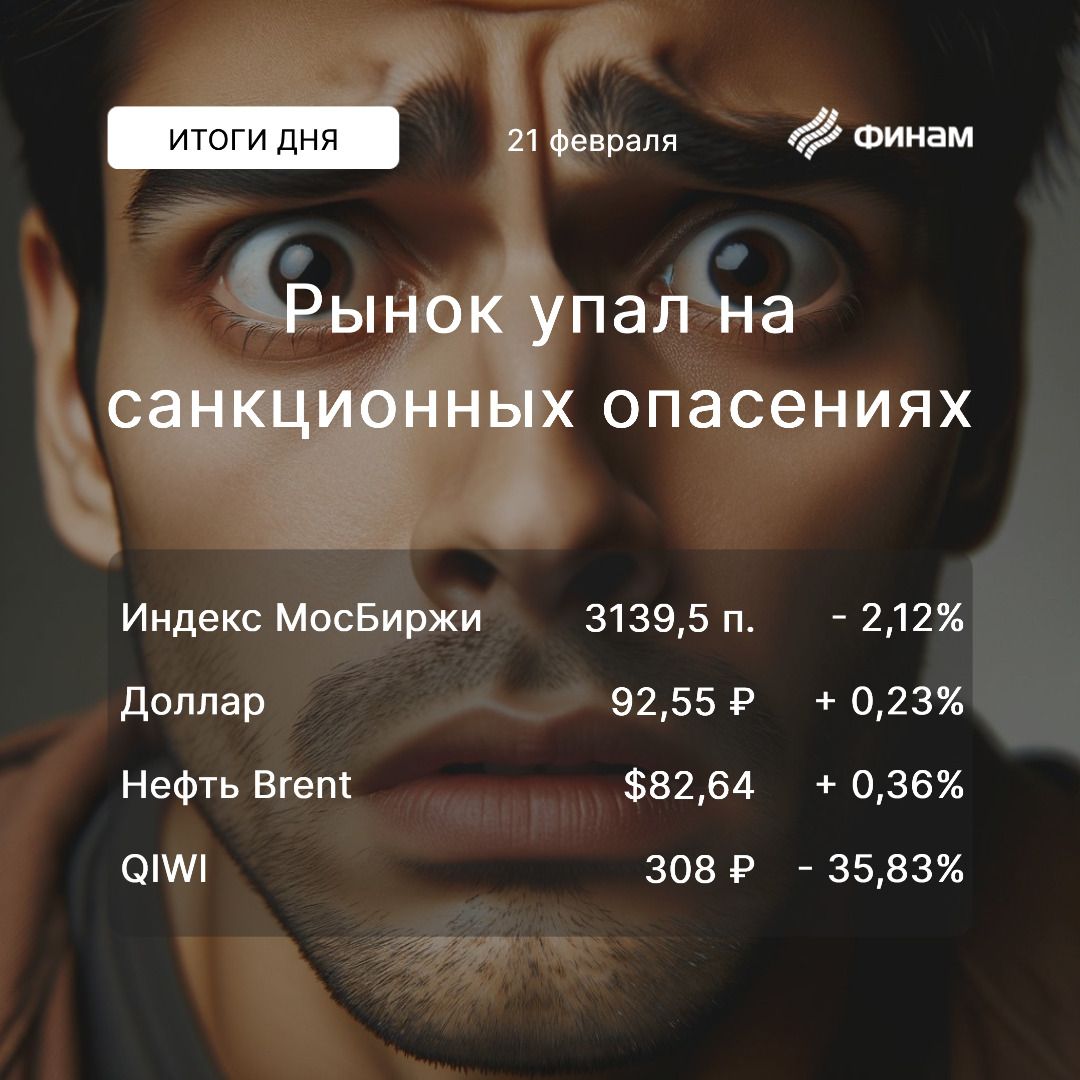

For the Russian market, another day ended in the red. The Moscow Exchange index finished Wednesday’s trading day down 2.12% to 3139.5 points, and the RTS index weakened by 2.33% to 1068.09 points.

The news of a new round of sanctions added to the pressure. According to the Reuters news agency, the European Union approved the 13th round of sanctions affecting 200 individuals and legal entities. In addition, new sanctions from the United States are expected to be announced on Friday. “Nevertheless, by the end of the day, the Russian stock market managed to slightly soften the decline and closed above the intraday low,” commented Polina Shchukina, an analyst at FINAM.

Manual for Russian financial institutions

Pessimism was also reinforced by a sharp drop in depositary receipts of the payment service Qiwi due to the revocation of the license of Qiwi Bank by the Central Bank of Russia. “Investors fear that the impact of this event will affect QIWI’s operational activities,” explained Natalya Milchakova, chief analyst at Freedom Finance Global. QIWI’s depositary receipts reacted to this news with a 32.71% decline. Short positions on these securities will be prohibited from February 22.

Start your journey to financial success with the FinamInvest app – save time searching for the right investment product and discover new ones, follow important stock market events in a smart news feed.The technologically advanced “Finam Diagnostics” service for analytical support of investors.

Today, Mezhdurechensk Coal Company (MCX: MECO) stocks showed weakness, declining by 7.8%, after the company reported its Q4 2023 and full-year 2023 results. The annual revenue of the company decreased by 6%, the quarterly revenue grew by 2%, EBITDA for the year decreased by 25%, and annual net profit dropped by 65%.

“Pref” shares of Transneft (MCX: TRMK) fell by 5.2% after trading resumed following a 1:100 stock split.

Stocks of Polymetal International (LON: POLY) fell by 8.2%, Evraz (LON: EVR) by 6.7%, Transneft (MCX: TRNF) by 5.1%, and Novolipetsk Steel (MCX: NLMK) by 3.7%. On the other hand, the shares of Rusal (HKEX: 0486) rose by 0.9%, MTS (MCX: MTSS) by 0.6%, Surgutneftegas (MCX: SNGS) by 0.4%, Moscow Exchange (MCX: MOEX) by 0.4%, Rostelecom (MCX: RTKM) by 0.4%, and Inter RAO (MCX: IROZ) by 0.09%.

AFK Sistema (MCX: AFKS) shares rose by 0.5% on news of a planned IPO of one of its currently non-public subsidiaries. The expectations of positive financial results for 2023 also supported the company’s shares.

Interesting to investors today was the news that the Krystal alcohol group set the price for the placement of shares in its IPO at 9.5 rubles per share – the upper limit of the price range. Within the framework of the IPO, 125 million new shares were placed.

Oil, which had been falling in price almost all day, was able to show a weak growth during the evening session. Overall, negative sentiments remain, given the renewed escalation in the situation in the Red Sea. Brent crude oil futures were unable to rise above $83 per barrel. “Among the key factors putting pressure on oil quotes are concerns about a decline in global demand for oil and the negative impact of the retention of high interest rates by central banks around the world,” said Anton Kravchenko, head of the stock department at FIRST.

It should be noted that tomorrow, data on oil and oil product reserves will be published. If inventories continue to rise, oil prices will come under pressure. Concerns about potential delivery disruptions due to the ongoing tensions in the Middle East also play a role in this.

At this time, Brent crude oil futures are trading at $82.68 per barrel, and Light crude oil futures are trading at $77.49 per barrel.

Today, the ruble showed strength against leading world currencies. On the Forex market, the dollar lost 0.5% (91.85 rubles), and the euro weakened by 0.5% (99.35 rubles). The strengthening of the Russian currency is supported by increased currency sales by Russian exporters and by the Central Bank of Russia following the holidays in China. In addition, the peak tax payments are approaching, during which exporters convert their foreign currency revenue to pay taxes. “It should be noted that additional currency sales have not contributed significantly to the strengthening of the ruble. This is likely due to increased sanction risks,” observed Anton Kravchenko.